CFD Forex trading has become an increasingly popular way for traders to profit from currency movements without owning the underlying assets. To maximize success, traders must adopt proven strategies that balance risk and reward. Fintana.com provides an excellent platform for executing these strategies with advanced trading tools, competitive spreads, and flexible leverage. This article explores the top CFD trading strategies for Forex pairs and how traders can leverage them on Fintana trading. 🚀

📈 Understanding CFD Trading on Fintana.com

CFDs (Contracts for Difference) allow traders to speculate on Forex price movements without actually buying or selling the currency. By using leverage, traders can open larger positions with a fraction of the required capital. However, it is crucial to implement the right trading strategies to mitigate risks and maximize profitability.

Fintana Forex offers traders access to a wide range of Forex pairs, real-time market data, and powerful risk management tools. Before starting, traders can visit www.fintana.com, complete the Fintana login, and explore the available trading options. 🔑

🔥 Best CFD Trading Strategies for Forex Pairs on Fintana

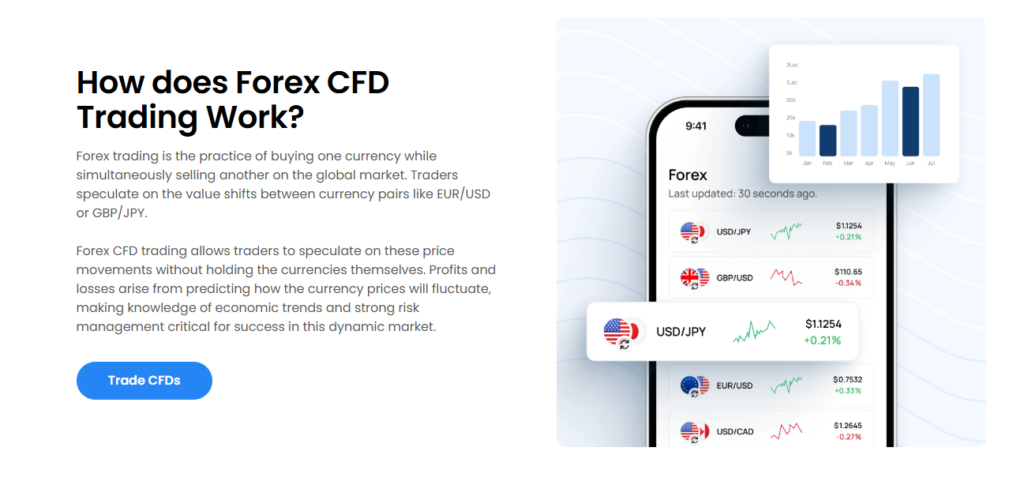

Image source: Fintana Forex

1️⃣ Scalping Strategy: Quick Profits from Small Moves

Scalping is a short-term trading strategy where traders open and close positions within minutes, aiming for small profits on each trade. It requires high-speed execution, low spreads, and precise market analysis.

✔ Best suited for: Active traders who can monitor charts constantly. 📊

✔ Key tools: Tight spreads, fast execution, and low latency (all available on Fintana broker).💡

✔ Risk: Requires discipline to avoid excessive trades that can lead to losses. ⚠️

2️⃣ Swing Trading: Capitalizing on Medium-Term Trends

Swing trading focuses on capturing price swings over days or weeks. Traders use technical and fundamental analysis to identify entry and exit points.

✔ Best suited for: Traders who prefer fewer but larger trades. 📉📈

✔ Key tools: Trend indicators (Moving Averages, RSI, MACD) on Fintana trading. 🛠️

✔ Risk: Requires patience as trades may take time to develop. ⏳

3️⃣ Trend Following: Riding the Market’s Momentum

The trend-following strategy involves trading in the direction of a dominant trend. Traders identify bullish or bearish trends and enter positions accordingly. Fintana.com provides trend indicators to help traders spot momentum.

✔ Best suited for: Traders who follow longer-term trends. 📊

✔ Key tools: Moving Averages, Bollinger Bands, and Fibonacci Retracements. 📉

✔ Risk: Trend reversals can cause sudden losses, so stop-losses are crucial. 🚨

4️⃣ Breakout Trading: Capturing Volatility for Big Gains

Breakout trading focuses on entering trades when price breaks key levels (support/resistance). This strategy aims to capture strong market movements.

✔ Best suited for: Traders who thrive on volatility. ⚡

✔ Key tools: Support/resistance levels, volume indicators, and news trading. 📰

✔ Risk: False breakouts can lead to losses, requiring tight stop-loss strategies. 🚧

5️⃣ Hedging Strategy: Minimizing Risk in Uncertain Markets

Hedging involves opening opposite positions to protect against market fluctuations. Traders on Fintana Forex can hedge positions using multiple Forex pairs to reduce exposure.

✔ Best suited for: Risk-averse traders looking to minimize losses. 🛡️

✔ Key tools: Correlated Forex pairs, stop-loss orders, and Fintana broker‘s risk management tools. ✅

✔ Risk: Reduced profit potential if both positions move favorably. 🤔

🛡️ Risk Management on Fintana Trading

Successful traders combine strategies with risk management techniques to protect their capital. Fintana trading ltd offers various tools to assist traders in managing risk effectively:

✔ Stop-Loss & Take-Profit Orders – Automate exits to lock in profits and minimize losses. 🔄

✔ Negative Balance Protection – Prevents accounts from going into a negative balance. 🚫

✔ Leverage Control – Adjust leverage settings based on risk tolerance. 📏

✔ Educational Resources – Fintana review sections provide insights on strategy optimization. 📚

🚀 Getting Started with Fintana Broker

For traders looking to execute CFD Forex strategies, signing up on Fintana.com is easy. By visiting www.fintana.com, users can create an account, access trading tools, and start applying these strategies instantly.

⭐ Why Choose Fintana Broker?

🔹 Regulated & trusted platform 🏦 with robust security measures 🔐.

🔹 Advanced trading tools 📊 for strategy execution.

🔹 Low spreads & high-speed execution ⚡.

🔹 User-friendly interface suitable for beginners & professionals. 🎯

🏁 Conclusion

Mastering CFD trading strategies is essential for success in the Forex market. Whether scalping, swing trading, trend following, breakout trading, or hedging, Fintana.com provides traders with the tools and resources needed to maximize potential profits while managing risk effectively. ✅

Check out Fintana’s reviews on some of the most popular review platforms: Topbrokers, TrustPilot and Topbrokers360.